CDS spreads and default risk : a leading indicator?

Contenido multimedia no disponible por derechos de autor o por acceso restringido. Contacte con la institución para más información.

| Tag | 1 | 2 | Value |

|---|---|---|---|

| LDR | 00000nam a22000004b 4500 | ||

| 001 | MAP20110036478 | ||

| 003 | MAP | ||

| 005 | 20110526085855.0 | ||

| 008 | 110525s2011 usa|||| ||| ||eng d | ||

| 040 | $aMAP$bspa | ||

| 084 | $a327.1 | ||

| 100 | 1 | $0MAPA20110017156$aGrossman, Robert | |

| 245 | 0 | 0 | $aCDS spreads and default risk$b : a leading indicator?$cRobert Grossman, Martin Hansen, Kevin DAlbert |

| 260 | $aNew York$bFitch Ratings$c2011 | ||

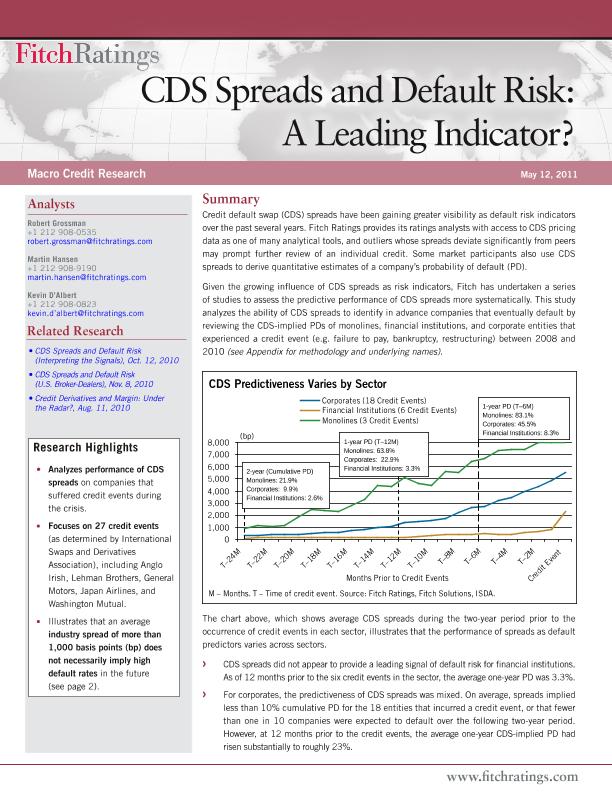

| 520 | $a Credit default swap (CDS) spreads have been gaining greater visibility as default risk indicators over the past several years. Fitch Ratings provides its ratings analysts with access to CDS pricing data as one of many analytical tools, and outliers whose spreads deviate significantly from peers may prompt further review of an individual credit. Some market participants also use CDS spreads to derive quantitative estimates of a company's probability of default (PD) | ||

| 650 | 1 | $0MAPA20080582401$aRiesgo crediticio | |

| 650 | 1 | $0MAPA20080614508$aInstrumentos financieros | |

| 650 | 1 | $0MAPA20080606527$aIncumplimiento de pago | |

| 650 | 1 | $0MAPA20080582586$aSeguro de crédito | |

| 700 | 1 | $0MAPA20110017163$aHansen, Martin | |

| 700 | 1 | $0MAPA20110017170$aD'Albert, Kevin | |

| 710 | 2 | $0MAPA20080438661$aFitch Ratings |