Solvency II has and will make corporate bonds more expensive

Contenido multimedia no disponible por derechos de autor o por acceso restringido. Contacte con la institución para más información.

| Tag | 1 | 2 | Value |

|---|---|---|---|

| LDR | 00000cam a22000004b 4500 | ||

| 001 | MAP20120052543 | ||

| 003 | MAP | ||

| 005 | 20121213160439.0 | ||

| 008 | 121213s2012 fra|||| ||| ||fre d | ||

| 040 | $aMAP$bspa$dMAP | ||

| 084 | $a219 | ||

| 100 | 1 | $0MAPA20120027930$aL'Hoir, Mathieu | |

| 245 | 0 | 0 | $aSolvency II has and will make corporate bonds more expensive$cby Mathieu LHoir & Mathilde Sauve |

| 260 | $aParis $bAXA Investment Managers$c2012 | ||

| 490 | 0 | $aInvestment Essentials$v28th November 2012 | |

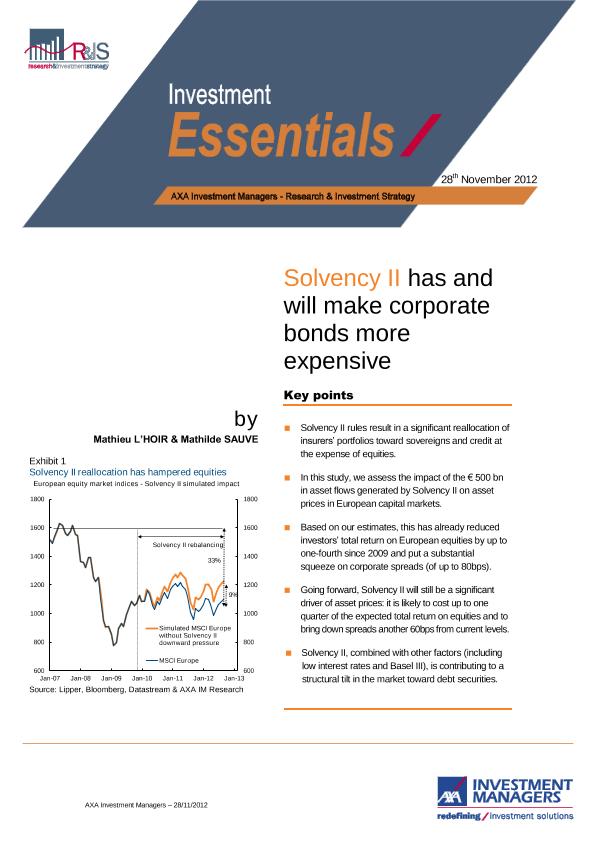

| 520 | $aAccording to our forecast, very large asset flows of about 500 bn come as a direct result of insurers shifting asset allocations in light of upcoming Solvency II regulations. This rebalancing process began at the end of 2009 and is likely to continue to unfold over the course of the next five years. The expected reallocation consequences of Solvency II are well known, encouraging insurers to reduce equity exposure and give preference to the less volatile short-term fixed income assets. As the study shows, this reallocation has already had an impact for instance, it may explain up to 25% of the current gap in equity prices with respect to pre-crisis price levels (Exhibit 2) and will continue to impact European equity and fixed income markets in the coming years | ||

| 650 | 1 | $0MAPA20080564254$aSolvencia II | |

| 650 | 1 | $0MAPA20080558970$aInversiones | |

| 650 | 1 | $0MAPA20080586317$aMercado de valores | |

| 650 | 1 | $0MAPA20080588816$aActivos financieros | |

| 650 | 1 | $0MAPA20080610029$aCotizaciones bursátiles | |

| 650 | 1 | $0MAPA20080611897$aPerspectivas económicas | |

| 700 | 1 | $0MAPA20120027947$aSauve, Mathilde | |

| 710 | 2 | $0MAPA20120027961$aAXA Investment Managers | |

| 830 | 0 | $0MAPA20120027954$aInvestment Essentials |