ROE-challenged P&C insurers need to ask, "What can change?" : five action steps to consider

Contenido multimedia no disponible por derechos de autor o por acceso restringido. Contacte con la institución para más información.

| Tag | 1 | 2 | Value |

|---|---|---|---|

| LDR | 00000cab a2200000 4500 | ||

| 001 | MAP20140040360 | ||

| 003 | MAP | ||

| 005 | 20141031135935.0 | ||

| 008 | 141031e20141030esp|||p |0|||b|spa d | ||

| 040 | $aMAP$bspa$dMAP | ||

| 084 | $a32 | ||

| 100 | 1 | $0MAPA20130017297$aStaudt, Andy | |

| 245 | 1 | 0 | $aROE-challenged P&C insurers need to ask, "What can change?"$b: five action steps to consider$cAndy Staudt |

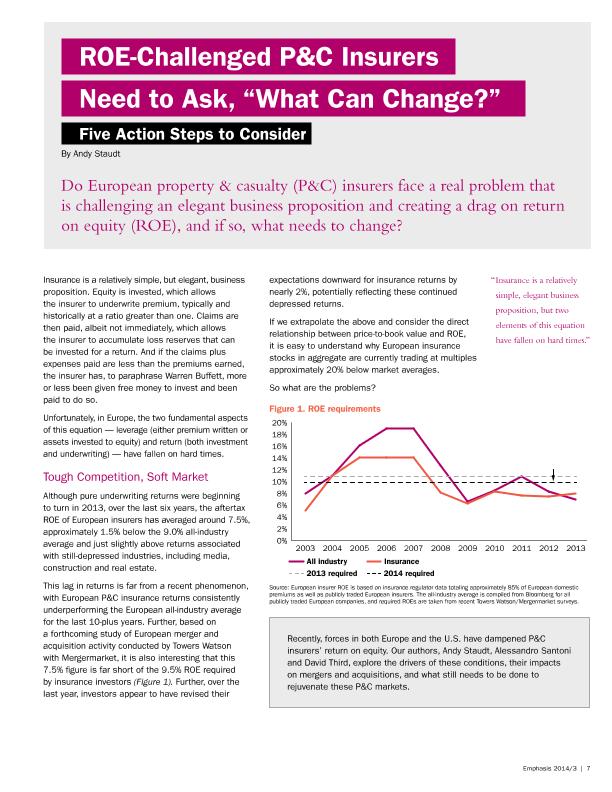

| 520 | $aAlthough pure underwriting returns were beginning to turn in 2013, over the last six years, the aftertax ROE of European insurers has averaged around 7.5%, approximately 1.5% below the 9.0% all- ndustry average and just slightly above returns associated with still-depressed industries, including media, construction and real estate.This lag in returns is far from a recent phenomenon, with European P&C insurance returns consistently underperforming the European all-industry average for the last 10-plus years. Further, based on a forthcoming study of European merger and acquisition activity conducted by Towers Watson with Mergermarket, it is also interesting that this 7.5% figure is far short of the 9.5% ROE required by insurance investors (Figure 1). Further, over the last year, investors appear to have revised their expectations downward for insurance returns by nearly 2%, potentially reflecting these continued depressed returns. If we extrapolate the above and consider the direct relationship between price-to-book value and ROE, it is easy to understand why European insurance stocks in aggregate are currently trading at multiples approximately 20% below market averages | ||

| 650 | 4 | $0MAPA20080624934$aSeguro de daños patrimoniales | |

| 650 | 4 | $0MAPA20080558970$aInversiones | |

| 650 | 4 | $0MAPA20080560447$aRendimiento | |

| 650 | 4 | $0MAPA20080536947$aROE | |

| 650 | 4 | $0MAPA20080563974$aRentabilidad | |

| 650 | 4 | $0MAPA20080577674$aRecursos propios | |

| 650 | 4 | $0MAPA20080590567$aEmpresas de seguros | |

| 651 | 1 | $0MAPA20080637743$aEuropa | |

| 773 | 0 | $wMAP20077000932$tEmphasis$dNew York : Towers Watson, 1987-$g30/10/2014 Número 3 - 2014 , p. 7-10 |