GE's long-term care exposure magnifies counterparty risk for several insurers

Contenido multimedia no disponible por derechos de autor o por acceso restringido. Contacte con la institución para más información.

| Tag | 1 | 2 | Valor |

|---|---|---|---|

| LDR | 00000cam a22000004b 4500 | ||

| 001 | MAP20190025553 | ||

| 003 | MAP | ||

| 005 | 20190902131902.0 | ||

| 008 | 190416e20190829usa|||| ||| ||eng d | ||

| 040 | $aMAP$bspa$dMAP | ||

| 084 | $a219 | ||

| 245 | 1 | 0 | $aGE's long-term care exposure magnifies counterparty risk for several insurers$cA.M. Best Company |

| 260 | $aNew Jersey$bA.M. Best Company$c2019 | ||

| 300 | $a5 p. | ||

| 490 | 0 | $aBest's Commentary$vLong-Term Care$vAugust 29, 2019 | |

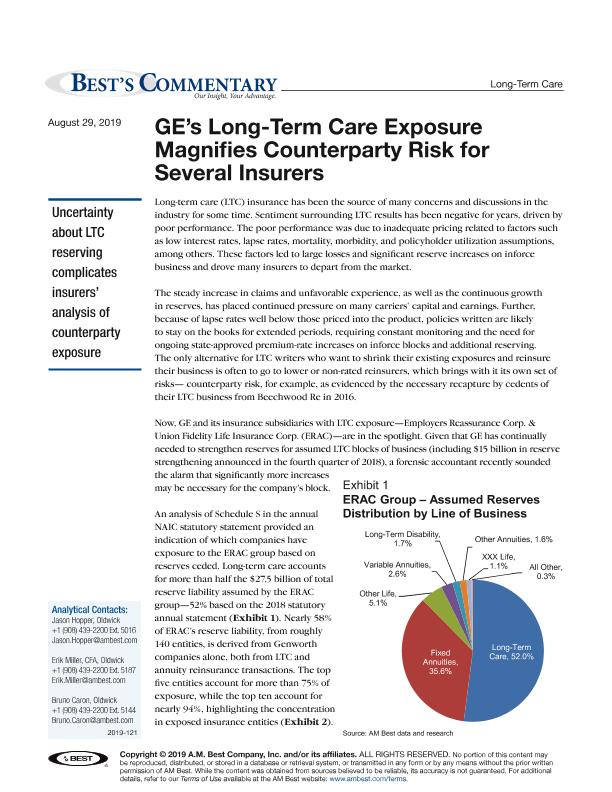

| 520 | $aLong-term care (LTC) insurance has been the source of many concerns and discussions in the industry for some time. Sentiment surrounding LTC results has been negative for years, driven by poor performance. The poor performance was due to inadequate pricing related to factors such as low interest rates, lapse rates, mortality, morbidity, and policyholder utilization assumptions, among others. These factors led to large losses and significant reserve increases on inforce business and drove many insurers to depart from the market. | ||

| 650 | 4 | $0MAPA20080586294$aMercado de seguros | |

| 650 | 4 | $0MAPA20100014189$aLong term care insurance | |

| 650 | 4 | $0MAPA20080611880$aPerspectivas del seguro | |

| 830 | 0 | $0MAPA20190004831$aBest's Commentary$vLong-Term Care ; August 29, 2019 |