Microfinance on the rise

Contenido multimedia no disponible por derechos de autor o por acceso restringido. Contacte con la institución para más información.

| Tag | 1 | 2 | Value |

|---|---|---|---|

| LDR | 00000cam a22000004b 4500 | ||

| 001 | MAP20080054267 | ||

| 003 | MAP | ||

| 005 | 20081215180553.0 | ||

| 008 | 081215s2008 gbr|||| ||| ||eng d | ||

| 040 | $aMAP$bspa$dMAP | ||

| 084 | $a921.94 | ||

| 245 | 1 | 0 | $aMicrofinance on the rise |

| 260 | $a[London]$bArthur D. Little$c2008 | ||

| 490 | 1 | $aFinancial services insight$vNovember'08 | |

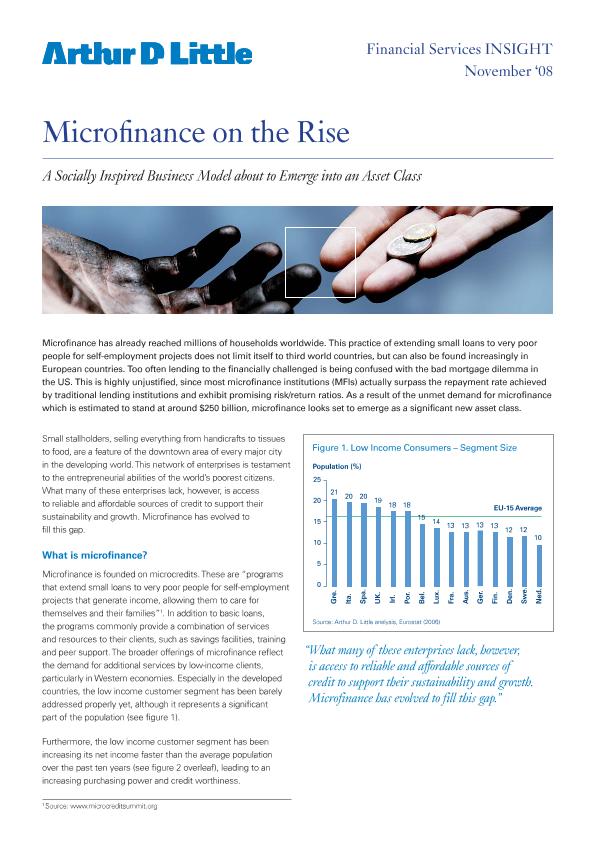

| 520 | $aMicrofinance has already reached millions of households worldwide. This practice of extending small loans to very poor people for self-employment projects does not limit itself to third world countries, but can also be found increasingly in European countries. Too often lending to the financially challenged is being confused with the bad mortgage dilemma in the US. This is highly unjustified, since most microfinance institutions (MFIs) actually surpass the repayment rate achieved by traditional lending institutions and exhibit promising risk/return ratios. As a result of the unmet demand for microfinance which is estimated to stand at around $250 billion, microfinance looks set to emerge as a significant new asset class | ||

| 650 | 1 | $0MAPA20080655341$aMicrocréditos | |

| 650 | 1 | $0MAPA20080603182$aProductos financieros | |

| 650 | 1 | $0MAPA20080591922$aMercados emergentes | |

| 650 | 1 | $0MAPA20080586461$aModelos de gestión | |

| 710 | 2 | $0MAPA20080440602$aArthur D. Little | |

| 830 | 0 | $0MAPA20080664008$aFinancial services insight$vNovember'08 |