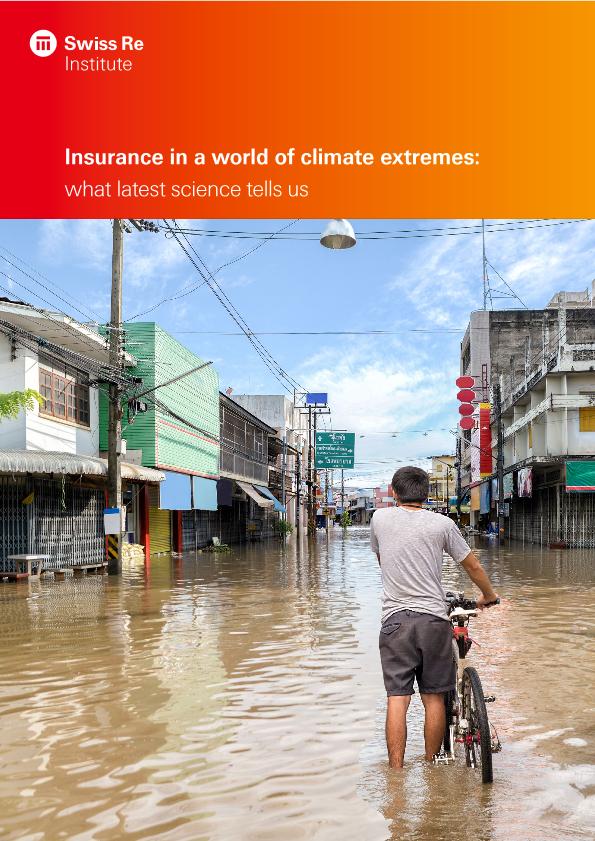

Insurance in a world of climate extremes : what latest science tells us

Contenido multimedia no disponible por derechos de autor o por acceso restringido. Contacte con la institución para más información.

| Tag | 1 | 2 | Value |

|---|---|---|---|

| LDR | 00000cam a22000004b 4500 | ||

| 001 | MAP20200000136 | ||

| 003 | MAP | ||

| 005 | 20200103131109.0 | ||

| 008 | 081126m20192019che|||| ||| ||eng d | ||

| 040 | $aMAP$bspa$dMAP | ||

| 084 | $a328.1 | ||

| 245 | 1 | 0 | $aInsurance in a world of climate extremes $b: what latest science tells us |

| 260 | $aZurich$bSwiss Re Institute$c2019 | ||

| 300 | $a11 p. | ||

| 520 | $aCurrent studies point to severe mid- to long-term consequences if climate change is not mitigated and global temperature increases are above 2°C pre-industrial levels, breaking that target of the Paris Agreement. Besides the human impact, the insurability of assets in highly exposed regions will be called into question. For insurability not to be threatened, adaptation to a profoundly changed risk landscape is required. Re/insurers can play a fundamental role in facilitating transition to a low-carbon economy by embedding sustainability as a core element in their business models, and by reducing their own carbon footprint. Besides shifting towards an environmentally sustainable asset portfolio, re/insurers should align their underwriting policies to reduce incentives that favour further carbon-intensive energy production and consumption. Industry-wide implementation of these principles will help build the world's resilience to a changing climate | ||

| 650 | 4 | $0MAPA20080574932$aCambio climático | |

| 650 | 4 | $0MAPA20140016556$aResiliencia | |

| 650 | 4 | $0MAPA20080586294$aMercado de seguros | |

| 650 | 4 | $0MAPA20090037380$aInversiones socialmente responsables | |

| 650 | 4 | $0MAPA20080570736$aSostenibilidad | |

| 650 | 4 | $0MAPA20080608835$aSuscripción de riesgos | |

| 650 | 4 | $0MAPA20120017993$aHuella del carbono | |

| 710 | 2 | $0MAPA20170013402$aSwiss Re Institute |