EMEA insurance market ratings : reviewing the impact of best´s credit rating methodology

Contenido multimedia no disponible por derechos de autor o por acceso restringido. Contacte con la institución para más información.

| Tag | 1 | 2 | Value |

|---|---|---|---|

| LDR | 00000cam a22000004b 4500 | ||

| 001 | MAP20200006022 | ||

| 003 | MAP | ||

| 005 | 20200228125131.0 | ||

| 008 | 190408e20200221usa|||| ||| ||eng d | ||

| 040 | $aMAP$bspa$dMAP | ||

| 084 | $a219 | ||

| 245 | 1 | 0 | $aEMEA insurance market ratings$b: reviewing the impact of best´s credit rating methodology$cA.M. Best Company |

| 260 | $aLondon$bA.M. Best Company$c2020 | ||

| 300 | $a15 p | ||

| 490 | 0 | $aBest's Market Segment Report$vFebruary 21, 2020 | |

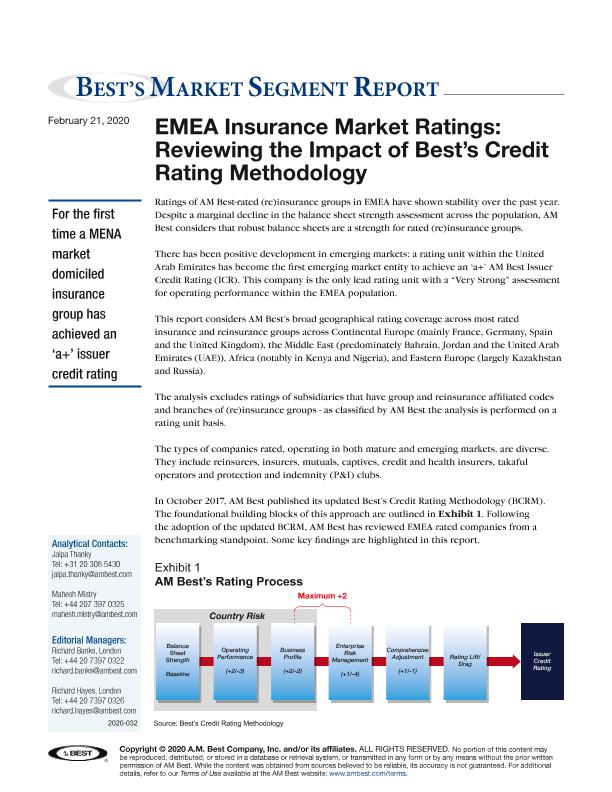

| 500 | $aRatings of AM best-rated (re)insurance groups in EMEA have shown stability over the past year. Despite a marginal decline in the balance sheet strenght assessment across the population, AM Best considers that robust balance sheets are a strenght for rated (re)insurance groups. There has been positive devolment in emerging market entity to achieve an 'a+' AM Best Issuer Credit Rating (ICR). This company is the only lead rating unit with a "very strong" assessment for operating performance within the EMEA population. | ||

| 650 | 4 | $0MAPA20080586294$aMercado de seguros | |

| 650 | 4 | $0MAPA20080591922$aMercados emergentes | |

| 650 | 4 | $0MAPA20080619008$aCalificaciones crediticias | |

| 650 | 4 | $0MAPA20080602529$aMercado de reaseguros | |

| 650 | 4 | $0MAPA20080611880$aPerspectivas del seguro | |

| 651 | 1 | $0MAPA20140027149$aEMEA | |

| 651 | 1 | $0MAPA20080637743$aEuropa | |

| 651 | 1 | $0MAPA20090034457$aOriente Medio | |

| 651 | 1 | $0MAPA20090034464$aÁfrica | |

| 710 | 2 | $0MAPA20080441371$aA.M. Best Company | |

| 830 | 0 | $0MAPA20180007804$aBest's Market Segment Report$vFebruary 21, 2020 |