Re-underwriting and De-risking in the Insurance-Linked Securities Market

Contenido multimedia no disponible por derechos de autor o por acceso restringido. Contacte con la institución para más información.

| Tag | 1 | 2 | Value |

|---|---|---|---|

| LDR | 00000cam a22000004b 4500 | ||

| 001 | MAP20220008808 | ||

| 003 | MAP | ||

| 005 | 20220317142646.0 | ||

| 008 | 220316s2022 usa|||| ||| ||eng d | ||

| 040 | $aMAP$bspa$dMAP | ||

| 084 | $a219 | ||

| 245 | 1 | 0 | $aRe-underwriting and De-risking in the Insurance-Linked Securities Market |

| 260 | $aOldwick [etc.]$bA.M. Best Company$c2022 | ||

| 300 | $a9 p. | ||

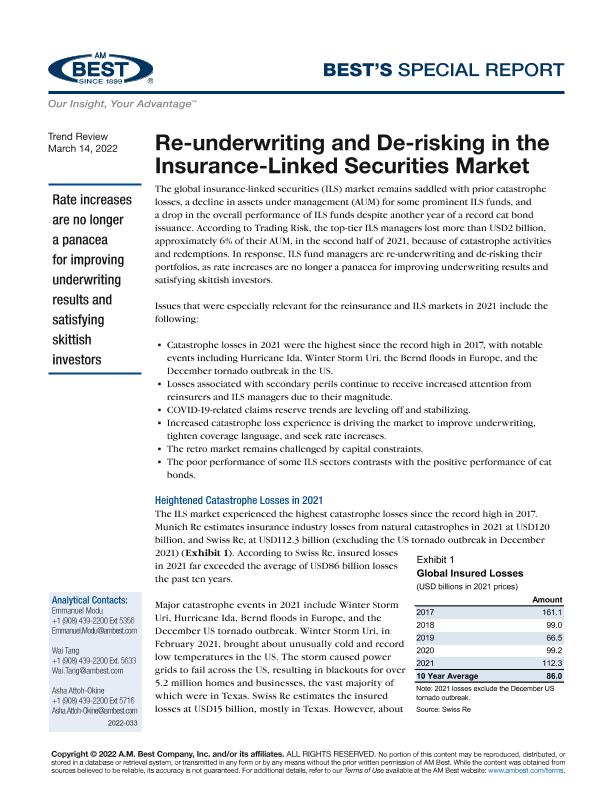

| 520 | $aThe global insurance-linked securities (ILS) market remains saddled with prior catastrophe losses, a decline in assets under management (AUM) for some prominent ILS funds, and a drop in the overall performance of ILS funds despite another year of a record cat bond issuance. According to Trading Risk, the top-tier ILS managers lost more than USD2 billion, approximately 6% of their AUM, in the second half of 2021, because of catastrophe activities and redemptions. In response, ILS fund managers are re-underwriting and de-risking their portfolios, as rate increases are no longer a panacea for improving underwriting results and satisfying skittish investors. | ||

| 650 | 4 | $0MAPA20190001113$aSeguros vinculados a valores | |

| 650 | 4 | $0MAPA20080586294$aMercado de seguros | |

| 650 | 4 | $0MAPA20080586317$aMercado de valores | |

| 650 | 4 | $0MAPA20080558970$aInversiones |