Realigning LTCI : private long-term care insurance and the health care continuum

Contenido multimedia no disponible por derechos de autor o por acceso restringido. Contacte con la institución para más información.

| Tag | 1 | 2 | Valor |

|---|---|---|---|

| LDR | 00000cab a2200000 4500 | ||

| 001 | MAP20210019890 | ||

| 003 | MAP | ||

| 005 | 20210922181057.0 | ||

| 008 | 210921e20210913esp|||p |0|||b|spa d | ||

| 040 | $aMAP$bspa$dMAP | ||

| 084 | $a344.1 | ||

| 245 | 1 | 0 | $aRealigning LTCI$b: private long-term care insurance and the health care continuum |

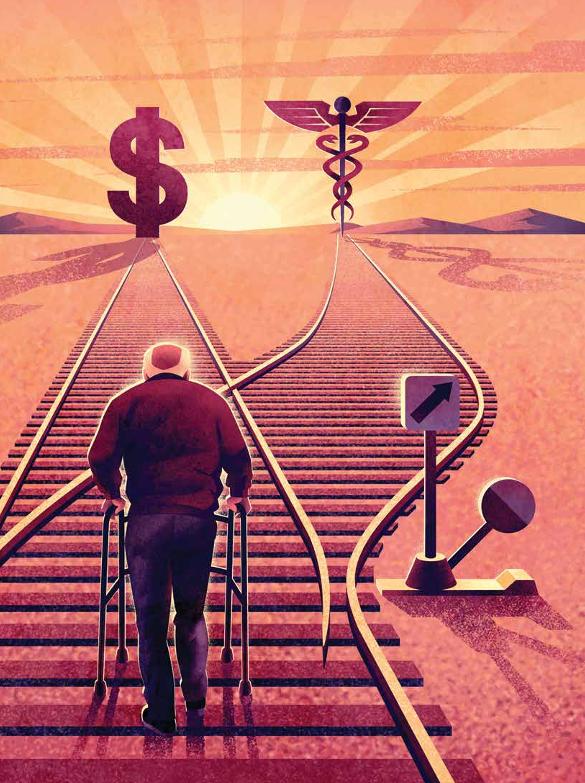

| 520 | $aFor more than 30 years, private long-term care insurance (LTCI) has been sold as a way to pay for expenses that can break a family's budget, strip a surviving spouse or partner of financial resources, or bankrupt an estate. Positioning the insurance in this way made good business sense at one time, but it tended to glide over the fact that long-term care (LTC) is a health event that can affect quality of life as well as threaten financial ruin. Every adult who has lived through the past year of COVID-19 with a family member in care recognizes that a person getting only custodial carethat is, supportive servicesmay at any time also require medical services for an acute health condition, such as that brought on by an infection. If the person is aged, medical intervention may be necessary due to other causes, such as a fall, fracture, or stroke, which require emergency measures, including hospitalization, intensive care, surgery, intravenous medication, and post-acute rehabilitative therapy. | ||

| 650 | 4 | $0MAPA20080626310$aSeguro de asistencia sanitaria | |

| 650 | 4 | $0MAPA20080603786$aSeguro de dependencia | |

| 650 | 4 | $0MAPA20080589356$aCálculo de la prima | |

| 773 | 0 | $wMAP20190020794$tContingencies : American Academy of Actuaries$dWashington : American Academy of Actuaries, 2019-$g13/09/2021 Año 2021 Número 5 - 2021 septiembre , 16-27 p. |