Replicated stratified sampling : a new financial modeling option

Contenido multimedia no disponible por derechos de autor o por acceso restringido. Contacte con la institución para más información.

| Tag | 1 | 2 | Value |

|---|---|---|---|

| LDR | 00000cab a2200000 4500 | ||

| 001 | MAP20110058661 | ||

| 003 | MAP | ||

| 005 | 20111006172021.0 | ||

| 008 | 111006e20110930esp|||p |0|||b|spa d | ||

| 040 | $aMAP$bspa$dMAP | ||

| 084 | $a7 | ||

| 100 | $0MAPA20110026493$aVadivelo, Jay | ||

| 245 | 0 | 0 | $aReplicated stratified sampling$b: a new financial modeling option$cby Jay Vadivelo |

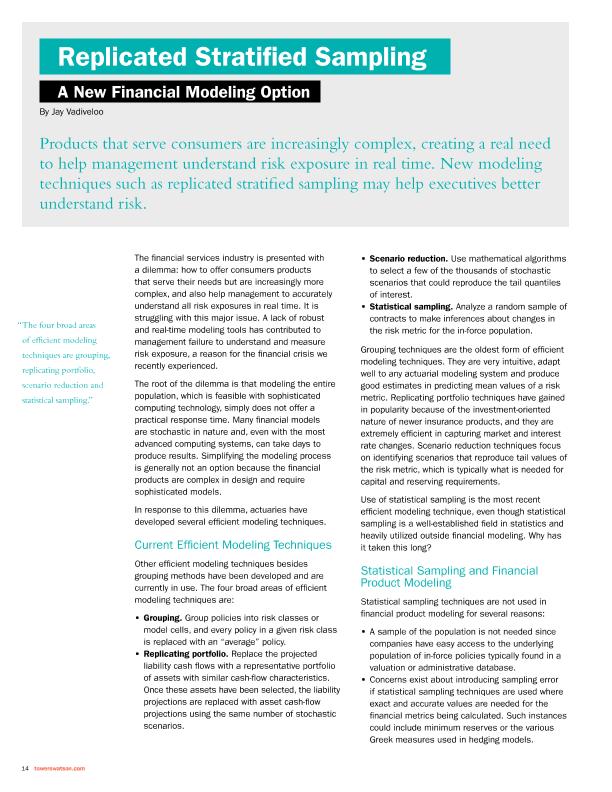

| 520 | $aThe financial services industry is presented with a dilemma: how to offer consumers products that serve their needs but are increasingly more complex, and also help management to accurately understand all risk exposures in real time. It is struggling with this major issue. A lack of robust and real-time modeling tools has contributed to management failure to understand and measure risk exposure, a reason for the financial crisis we recently experienced. The root of the dilemma is that modeling the entire population, which is feasible with sophisticated computing technology, simply does not offer a practical response time. Many financial models are stochastic in nature and, even with the most advanced computing systems, can take days to produce results. Simplifying the modeling process is generally not an option because the financial products are complex in design and require sophisticated models | ||

| 650 | 1 | $0MAPA20080591182$aGerencia de riesgos | |

| 650 | 1 | $0MAPA20080621391$aFinanciación de los riesgos | |

| 650 | 1 | $0MAPA20080586461$aModelos de gestión | |

| 650 | 1 | $0MAPA20080603908$aServicios financieros | |

| 710 | 2 | $0MAPA20100009338$aTowers Watson | |

| 773 | 0 | $wMAP20077000932$tEmphasis$dNew York : Towers Watson, 1987-$g30/09/2011 Número 3 - 2011 , p. 14-17 |