Global markets overview : asset research team. August 2021

Contenido multimedia no disponible por derechos de autor o por acceso restringido. Contacte con la institución para más información.

| Tag | 1 | 2 | Valor |

|---|---|---|---|

| LDR | 00000cam a22000004 4500 | ||

| 001 | MAP20212025433 | ||

| 003 | MAP | ||

| 005 | 20210901131009.0 | ||

| 008 | 210831s20210801gbr|||| ||| ||eng d | ||

| 040 | $aMAP$bspa$dMAP | ||

| 084 | $a921.4 | ||

| 245 | 1 | 0 | $aGlobal markets overview$b: asset research team. August 2021 |

| 260 | $aLondon$bWillis Towers Watson$c2021 | ||

| 300 | $a6 p. | ||

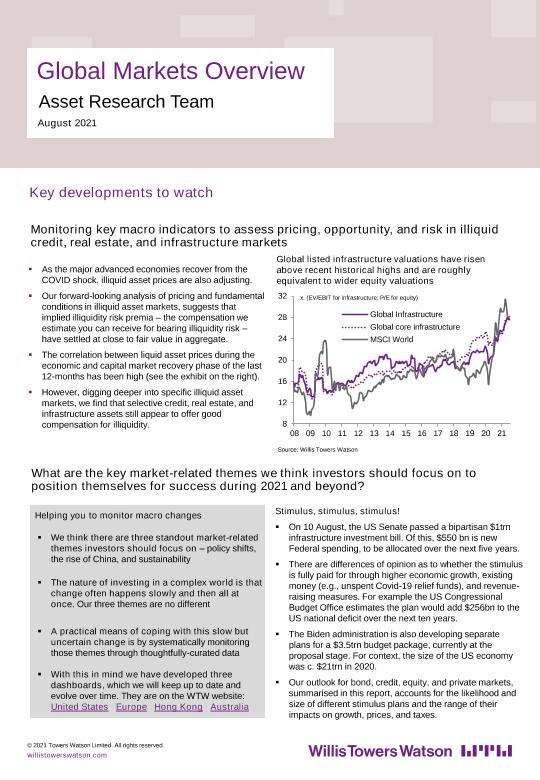

| 520 | $aAs the major advanced economies recover from the COVID shock, illiquid asset prices are also adjusting. Our forward-looking analysis of pricing and fundamental conditions in illiquid asset markets, suggests that implied illiquidity risk premia - the compensation we estimate you can receive for bearing illiquidity risk - have settled at close to fair value in aggregate. The correlation between liquid asset prices during the economic and capital market recovery phase of the last 12-months has been high (see the exhibit on the right). However, digging deeper into specific illiquid asset markets, we find that selective credit, real estate, and infrastructure assets still appear to offer Good compensation for illiquidity. | ||

| 650 | 4 | $0MAPA20080597641$aMercados financieros | |

| 650 | 4 | $0MAPA20080611897$aPerspectivas económicas | |

| 650 | 4 | $0MAPA20080582418$aRiesgo financiero | |

| 650 | 4 | $0MAPA20080573287$aPolítica fiscal | |

| 650 | 4 | $0MAPA20080600648$aCrecimiento económico | |

| 650 | 4 | $0MAPA20080551346$aInflación | |

| 710 | 2 | $0MAPA20170016144$aWillis Towers Watson |