Trackling the insurance protecition gap : leveraging climate mitigation and nature to increase resilience

Contenido multimedia no disponible por derechos de autor o por acceso restringido. Contacte con la institución para más información.

| Tag | 1 | 2 | Valor |

|---|---|---|---|

| LDR | 00000cam a22000004 4500 | ||

| 001 | MAP20260001548 | ||

| 003 | MAP | ||

| 005 | 20260129102153.0 | ||

| 008 | 260129s2026 che|||| ||| ||eng d | ||

| 040 | $aMAP$bspa$dMAP | ||

| 084 | $a328.1 | ||

| 110 | 2 | $0MAPA20080444167$aWorld Wildlife Found | |

| 245 | 1 | 0 | $aTrackling the insurance protecition gap$b: leveraging climate mitigation and nature to increase resilience |

| 260 | $aSwitzerland$bWorld Wildlife Found$c2026 | ||

| 300 | $a80 p. | ||

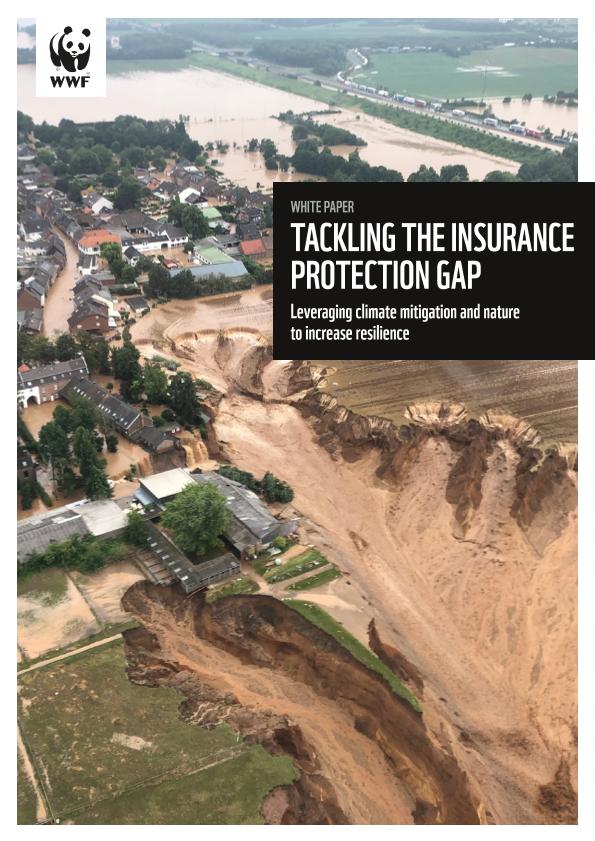

| 505 | 0 | $aIntroduction -- How climate change and nature destruction are driving economic losses from extreme weather events: The interplay between climate, nature and extreme weather events; Economic costs associated with climate change -- Climate risk and the insurance protection gap: Extreme weather challenges traditional insurance models; The impact of escalating climate risks on property insurance; How climate change and nature loss affect all insurance sectors -- The financial, economic, social and fiscal consequences of the protection gap: Risk transmission channels to the financial system, the economy and public finances; Effects of climate risk on mortgages and real estate markets; The protection gap, household income and intergenerational wealth; Climate-driven insurance pressures on business growth and competitiveness; How the protection gap burdens public finances -- Regulatory and policy responses to the widening protection gap: Government initiatives to reduce the protection gap; Government measures to increase risk prevention and resilience; How central banks and financial supervisors are stepping up -- Wwf recommendations to contain the protection gap for the benefit of people, nature, businesses and governments: Undertake holistic and forward-looking risk and resilience assessments, including indirect losses; Reduce ghg emissions and nature destruction domestically and through international cooperation to contain mutually reinforcing climate and nature risks; Make nature and nature-based solutions a centrepiece in adaptation and resilience planning and in response and recovery efforts; Enhance policy incentives and insurance regulation to support risk transfer solutions and financial resilience -- Conclusion -- Endnotes -- Effects of storm alice in paiporta, spain. image: © brais lorenzo | |

| 520 | $aInsurance is one of the cornerstones of modern prosperity. By underwriting and mutualizing risks, the insurance system enables investment, protects livelihoods, accelerates recovery after adverse events and underpins economic development. In regions with high insurance penetration, post-disaster recovery is not only faster, but its costs are more orderly and equitably distributed. Insurance provides financial protection for homes, businesses, public infrastructure and finances and, ultimately, people's wellbeing | ||

| 650 | 4 | $0MAPA20080586294$aMercado de seguros | |

| 650 | 4 | $0MAPA20210003813$aMitigación de riesgos | |

| 650 | 4 | $0MAPA20080574932$aCambio climático | |

| 650 | 4 | $0MAPA20080600204$aCatástrofes naturales | |

| 650 | 4 | $0MAPA20080629755$aSeguro de riesgos extraordinarios | |

| 650 | 4 | $0MAPA20080615284$aRiesgos medioambientales | |

| 650 | 4 | $0MAPA20190012508$aBrecha de protección | |

| 710 | 2 | $0MAPA20080444167$aWorld Wildlife Found | |

| 856 | $uhttps://www.wwf.eu/?20531391/Tackling-the-insurance-protection-gap---WWF-report |