A Growth model for Islamic banking

Contenido multimedia no disponible por derechos de autor o por acceso restringido. Contacte con la institución para más información.

| Tag | 1 | 2 | Valor |

|---|---|---|---|

| LDR | 00000nab a2200000 i 4500 | ||

| 001 | MAP20071507272 | ||

| 003 | MAP | ||

| 005 | 20080418125440.0 | ||

| 007 | hzruuu---uuuu | ||

| 008 | 051103e20051001usa|||| | |00010|eng d | ||

| 040 | $aMAP$bspa | ||

| 084 | $a921.91 | ||

| 100 | 1 | $0MAPA20080278892$aBenaissa, Nasr-Eddine | |

| 245 | 1 | 0 | $aA Growth model for Islamic banking$cNasr-Eddine Benaissa, Mayank P. Parekh and Michael Wiegand |

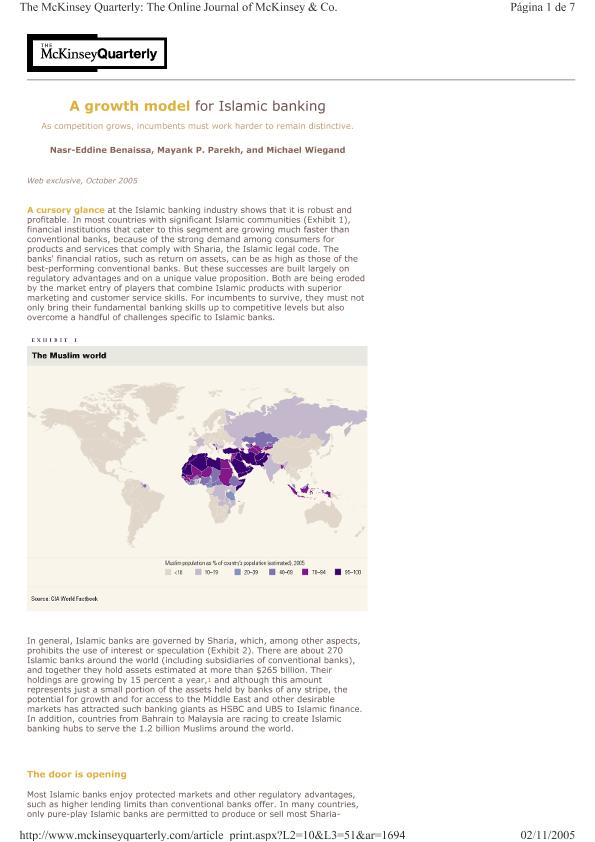

| 520 | 8 | $aIslamic banks are governed by Sharia, which, among other aspects, prohibits the use of interest or speculation. There are about 270 Islamic banks around the world (including subsidiaries of convenional banks), and together they hold assets estimated at more than 265 billion dollars. Their holdings are growing by 15 percent a year, and although this amount represents just a small portion of the assets held by banks of any stripe, the potential for growth and for access to the Middle East and other desirable markets has attracted such banking giants as HSBC and UBS to Islamic finance. In addition, countries from Bahrain to Malaysia are racing to create Islamic banking hubs to serve the 1.2 billion Muslims around the world$265 billion. Their holdings are growing by 15 percent a year, and although this amount represents just a small portion of the assets held by banks of any stripe, the potential for growth and for access to the Middle East and other desirable markets has attracted such banking giants as HSBC and UBS to Islamic finance. In addition, countries from Bahrain to Malaysia are racing to create Islamic banking hubs to serve the 1.2 billion Muslims around the world | |

| 650 | 0 | 1 | $0MAPA20080538217$aBanca |

| 650 | 1 | $0MAPA20080566760$aPaíses árabes | |

| 650 | 1 | 1 | $0MAPA20080615659$aTransacciones exteriores |

| 700 | 1 | $0MAPA20080202729$aParekh, Mayank P. | |

| 700 | 1 | $0MAPA20080182731$aWiegand, Michael | |

| 710 | 2 | $0MAPA20080442569$aMcKinsey & Company | |

| 773 | 0 | $dNew York : Mckinsey & Company$gOctober 2005 ; [7] p$tThe McKinsey Quarterly : web exclusive |